There are several factors to consider when analyzing an investment property. It can seem daunting at first, but if you take things one step at a time, research thoughtfully, trust tradespersons, and prepare — you will build the conviction necessary to change your life.

Select a Location and Investment Budget

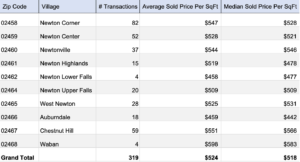

Look for properties in areas with strong economic growth potential. Consider checking the US Census databases, speaking with local economic advisory committees, and local realtors. Once you narrow in on a few communities, set your budget and work with your realtor to determine a target property class. Only invest what you are comfortable with; as with any investment there is risk.

Check the Condition and Rental Rates

Consider the condition of the property and any needed repairs or renovations. These costs should be factored into your investment analysis. If you intend to invest in value-add categories, find an agent with relevant experience and see what contractors they recommend. Electrical, plumbing, HVAC, and kitchen remodels don’t come cheap, especially when you factor in the lost time.

Research the rental market in the area to determine the potential rental income for the property. This can help you determine whether the property will generate enough income to cover the mortgage and other expenses such as property tax and insurance.

If you plan to hire a property management company to oversee the property, consider the cost of these services and how they will affect your return on investment. Judiciously analyze the potential return using real estate analysis templates and ask your agent to provide recently sold MLS comps.

Finance, Fill and Forecast

There are a variety of financing methods available, and you will need to have your paperwork in order. A mortgage broker can help keep you on track, and your buying agent should be able to help you rent the property as soon as it becomes available.

Forecast your rental performance and pat yourself on the back — you’re a landlord now!