1. Days on Market (DOM)

The moment your property goes on the market, the clock starts ticking against you. According to research, overall interest in a property starts to decline after it has sat on the market for more than 14 days. As a leading indicator, agents will assess how quickly properties are going under contract in a local area and infer whether the area is “hot”.

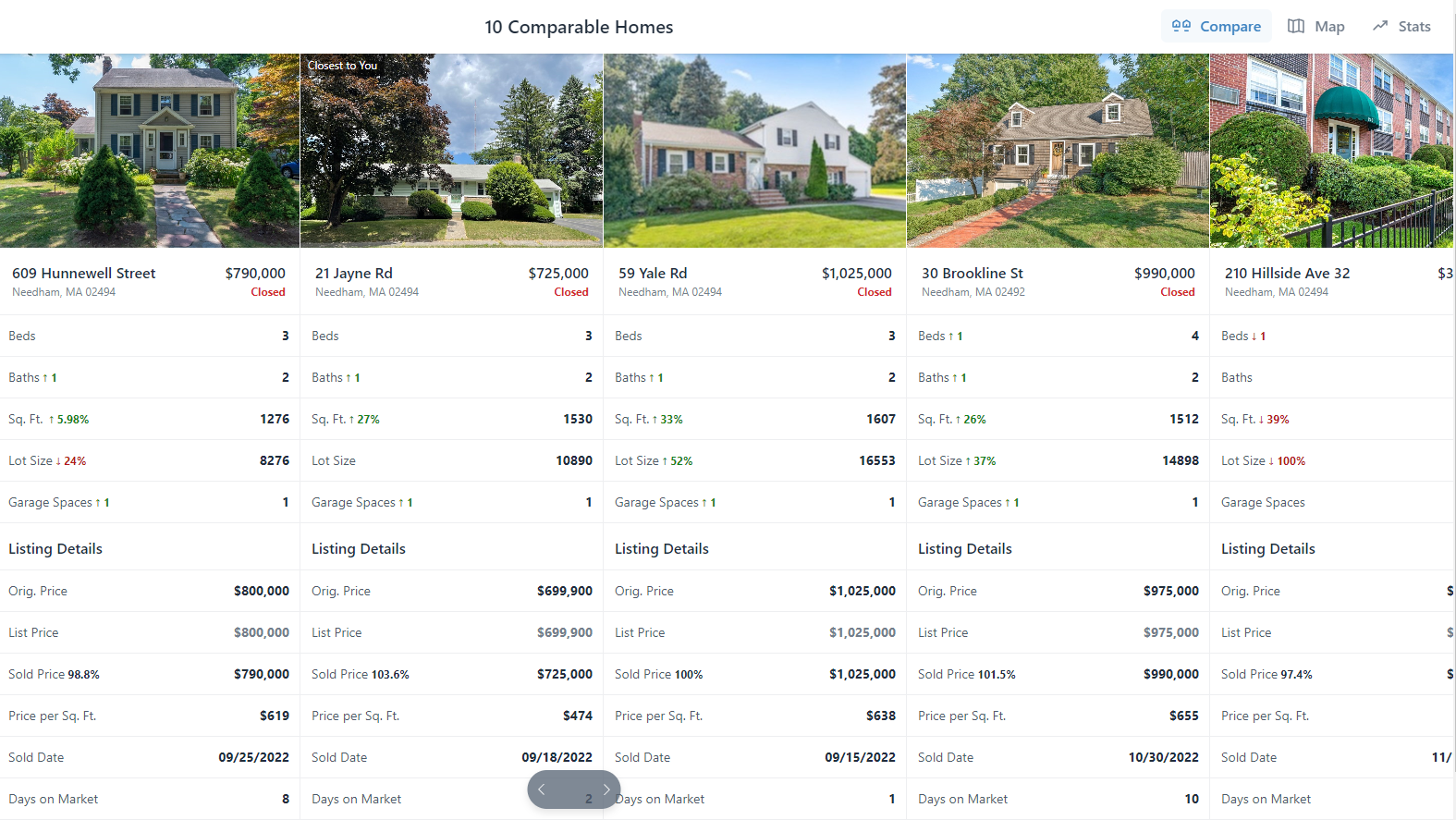

2. Sale to List Ratio

If you take the ultimate sale price of a property and divide it by the initial list price, you will see if sellers are getting the price they want in an area. While not an ironclad statistic, the ratio helps agents gauge how “hot” a market was 30 days ago (due to contract data gaps), and what pricing strategies have been most effective in the area.

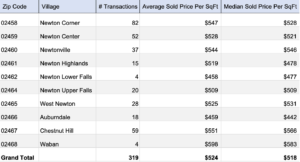

3. Sale Price Per Square Foot (PPSF)

Agents will often take the average price per square foot of nearby, recently sold (6 or 3 months) and comparably sized homes (+/- 10%). They can then dig deeper and assess whether your property presents better or worse than those comparable sales.

4. Feature Adjustments

Did your neighbor’s home that just sold have Central Air? If yours doesn’t, don’t be surprised to see an adjustment in your valuation. Agents typically have a sense of what home improvements costs are and will adjust your valuation up/down based on local comparable properties. Check out which home improvements have the greatest return on investment.

5. Appraisal Multiplier

Agents aren’t alone in assessing your property value. Both the government and banks use professional appraisers to estimate the value. While bank appraisals are important for obtaining financing, they are not publicly available. Tax appraisals are publicly available and shown on public record. Due to market demand, properties typically sell for more than their appraised value and this multiple can be calculated for comparable sales and applied to project your market value.

6. Redevelopment Upside

Certain parcels of land have more development upside. This largely depends on the town’s zoning maps, the total square footage of the land, property setbacks, and topography.

7. Interest Rates

A macroeconomic factor that directly impacts real estate is the availability of credit. When credit is readily available (interest rates are low), prices of assets, in this case property, remain high. When interest rates rise, prices begin to decline as buyer purchasing power decreases.